arizona solar tax credit 2022

The 2021 Arizona State Income Tax Return forms for Tax Year 2021 Jan. State Local and Utility Incentives.

Az Payback Png 720 640 Fear Of Commitment Incentive Infographic

On a cost per watt W.

. You can even keep doing this as long as the tax credit is active. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Based on the type and the amount your tax credit may vary.

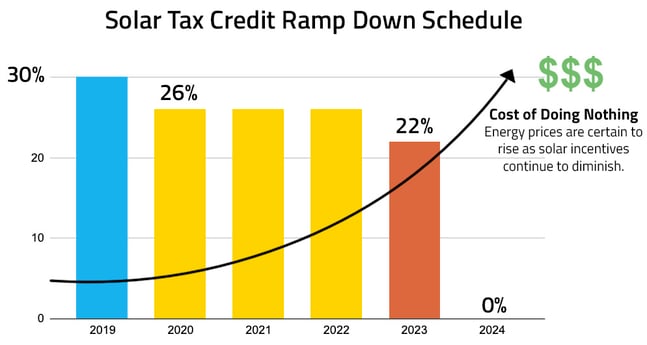

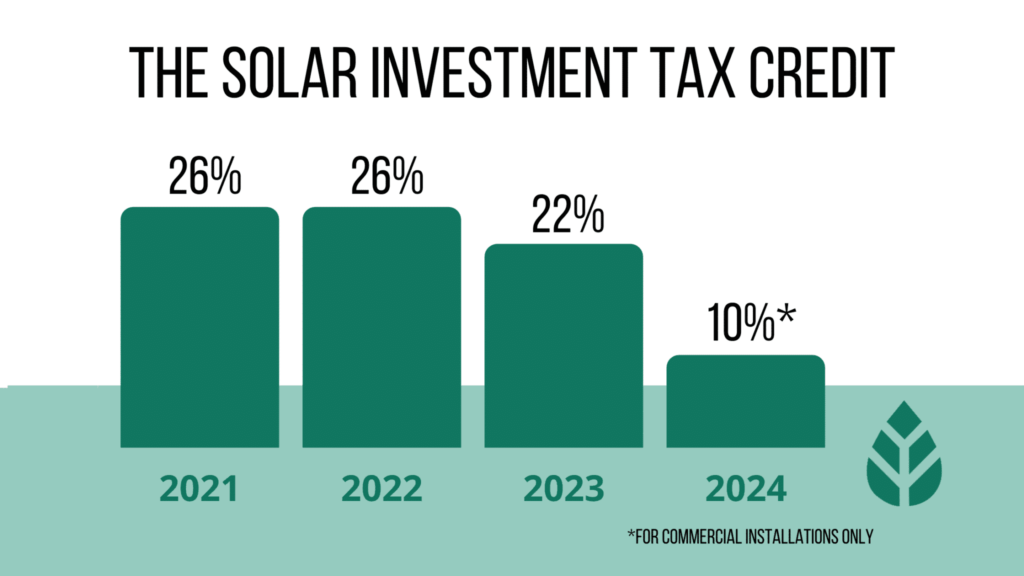

On part 1 of the form. KOLD News 13 - A new film tax incentive bill was introduced to the state legislature this week and has the potential to make Arizona a hotspot for movie making. The credit dwindles to 22 in 2023 and expires.

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. The Arizona Department of Revenue ADOR is reminding businesses that have not renewed their 2022 Transaction Privilege Tax TPT License to complete the licensing renewal processClick here for more information.

There are 25 states that offer sales tax exemptions for solar energy. The tax credit covers 10 of the total cost of. Arizona has a state income tax that ranges between 259 and 45 which is administered by the Arizona Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms.

The Solar Massachusetts Renewable Target SMART Plan is also available to solar installations until. New MA residential solar arrays are eligible for a 15 State tax credit up to 1000 a solar Sales Tax exemption and a solar Property Tax exemption. The cost of a solar panel installation in 2022 ranges from 17538 to 23458 after taking into account the federal solar tax credit.

Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates. On or after January 1 2024 The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. A Democratic proposal to create a new tax credit for working low-income Arizonans that Republican Gov.

To claim the solar investment tax credit in 2022 you will need to complete form 5695 when you lodge your tax return. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateHowever if you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyIf you owe Taxes and dont pay on time you might face late tax payment. Tax Credits Rebates.

If your tax burden in 2021 is less than the full amount of your credit you can carry over the remainder when filing your taxes in 2022. Sign Up for Email Updates. Sadly the amazing solar tax credit that caused such growth for the solar industry is on its proverbial last leg.

In 2022 the tax credit will be 26 and in 2023 it will step down to 22. The tax credit program covers a lot of different systems and energy efficient products. That is a nice bonus to add to the 26 Federal Solar Tax Credit.

The current tax year is 2021 with tax returns due in April 2022. In other words instead of just. Arizona solar tax credit.

For example certain products such as Energy Star rated windows doors and skylights insulation and metal or asphalt roofs get a percentage of costs. The AZFSET Portal will be unavailable on Wednesday February 16 from 500 pm. The federal investment tax credit ITC is far and away the best solar incentive.

Starting in 2024 the tax credit is scheduled to be removed altogether. Bill has the potential to make Arizona a hotspot for movie making once again. Solar Tax Credits Rebates.

Theres no cap on the federal tax credit and it can be claimed over multiple years if necessary. Some states like Arizona even offer a 10 tax credit to help offset the cost of commercial solar panels. The Geothermal Tax Credit can offset regular income taxes and even.

Colorado exempts from the states sales and use tax all sales storage and use of components used in the production of alternating current. Arizona has a state income tax that ranges between 2590 and 4500. HOW MUCH LONGER IS THE SOLAR TAX CREDIT AVAILABLE.

January 1 2023 to December 31 2023. There are several Arizona solar tax credits and exemptions that can help you go solar. The average cost to install solar panels is from 10626 to 26460 after tax credit for a 6kW to 12kW system to power an entire house.

January 1 2020 to December 31 2022. A single solar panel costs between 200 and 250. Most solar panels last for 50 years have a 25-year warranty and start generating a return on.

For example a residential federal tax credit allows taxpayers to claim 26 of installation costs for systems placed in service by Dec. The ITC gives back 26 percent of what you paid for solar on your taxes. HomeThe price per watt for solar panels can range from 250 to 350 and largely depends on the homes geographical areaResidential solar panels are usually sized at 3kW to 8kW and can cost anywhere from 9255 and 28000 in total installation costs.

3 2022 at 450 PM MST. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Arizona for example provides a sales tax exemption for the retail sale of solar energy devices and for the installation of solar energy devices by contractors.

If you are eligible for a state tax credit you. SW Washington DC 20585 202-586-5000. Government agencies utilities and others offer several key types of federal state and utility incentives that support energy efficiency promote the use of renewable energy sources help to reduce or buy down the upfront cost of a rooftop PV system andor offer a short-term credit on a customers utility.

Residential Arizona solar tax credit. On average a 10 kilowatt kW solar panel installation costs 20498 after taking into account the federal solar tax credit 27700 before the tax credit. In 2023 the credit goes down to 22 and you likely wont be able.

The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application. Tax credit bill aims to attract moviemakers to Arizona. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310.

The top-rated Arizona solar tax credit and state incentives. Commercial facility owners are allowed to deduct up to 85 of the total value of their solar. Doug Ducey adopted as part of his budget proposal was approved by an Arizona Senate committee.

Instead of a deduction which reduces your taxable income as would happen with any charitable donations you make in a year a tax credit directly offsets what you would otherwise owe in taxes. The average solar panel payback period is 7 to 12 years and solar energy saves 600 to 2000 per year on electricity costs. The general tax credit will save new solar installers up to 30 of the cost of your commercial solar panel installation.

Solar panel installation costs a national average of 18500 for a 6kW solar panel system for a 1500 square ft. Facebook Twitter Youtube Instagram Linkedin. The dates above reflect the extension.

Most states will release updated tax forms between January and April. Through 2022 the solar tax credit is good for 26 of the system costs.

Solar Tax Exemptions Sales Tax And Property Tax 2022

Federal Solar Tax Credit 2022 How Does It Work Sunpro Solar

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Cleaning Service And Cleane Tools Sofa Cleaning Services Flat Design Icon Cleaning Service

A Collection Of The Best Infographics 2022 Edition Ever 2022 Edition Make A Website Hub Mission To Mars Best Design Books Mission

Floating Solar Facts Https Www Scientificamerican Com Article Putting Solar Panels On Water Is A Great Idea Mdash But Will I Solar Facts Solar Solar Activity

Ring Nebula S True Shape M57 Hubble Jpl Nasa Space Telescope Photo Hs 2013 13 Ebay In 2022 Hubble Telescope Planetary Nebula Space Telescope

Solar Power Rocks 2013 State Solar Power Rankings Virginia Ranked 33rd In The Nation With A D Grade While Neighboring States Nc A Solar Power Solar Power

We Could Power The Entire World By Harnessing Solar Energy From 1 Of The Sahara

The Extended 26 Solar Tax Credit Critical Factors To Know

Manuel Franco Sevilla Photo Credit Sonia Fernandez To Anyone But A Physicist It Sounds Like Something Out Of Star Trek Physicists Physics Advanced Physics

Cost Of Solar Panels In 2022 What To Expect Ecowatch

File Comparison Optical Telescope Primary Mirrors Svg James Webb Space Telescope Largest Telescope Telescopes

Neemuch Solar Park Madhya Pradesh India

Federal Solar Tax Credit How Much Will You Get Back 2022 Ecowatch

40 Of The Best Infographics To Inspire You Canva Chakra Meditation Chakra Meditation

Federal Solar Tax Credit How Much Will You Get Back 2022 Ecowatch